Risk Management in Retail Banking

Date:12.02.2024

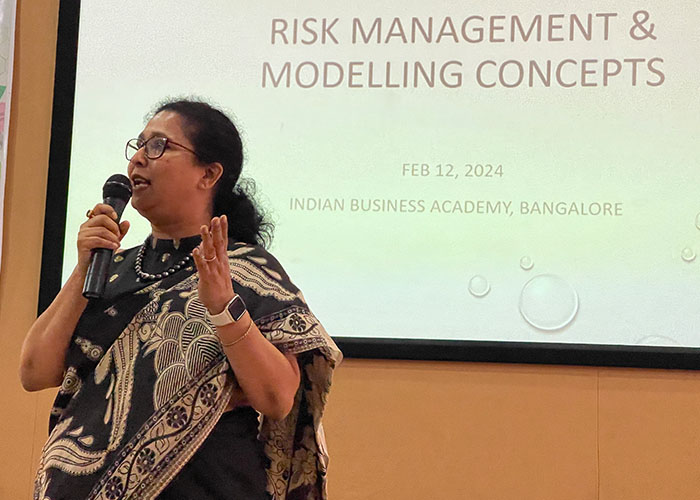

Speaker: Ms. Haimanti Biswas

In an informative session led by Ms. Haimanti Biswas on risk management and modelling, students delved into the intricate landscape of financial risk. With a comprehensive overview, Ms. Biswas elucidated various types of risks, shedding light on their significance in financial decision-making. One focal point of the discussion was the pivotal role of the CIBIL score, emphasizing its importance as a metric for assessing creditworthiness and mitigating financial risks.

Moreover, attendees gained insights into the tenets of credit risk management, equipping them with tools to navigate the complexities of lending and borrowing. Understanding these principles not only empowers individuals and businesses to make informed financial decisions but also bolsters strategic financial planning endeavours.

By fostering a deeper comprehension of risk dynamics and credit assessment methodologies, Ms. Ron’s session catalysed a paradigm shift in the approach towards financial management. Armed with newfound knowledge, participants are better equipped to identify, analyse, and mitigate risks, thereby fortifying their financial resilience and driving sustainable growth.

In essence, Ms. Haimanti Biswas’s session served as a beacon of enlightenment, illuminating pathways to sound financial stewardship and strategic planning in an ever-evolving economic landscape.